It has been

a turbulent time for Apple investors as the share price fell from highs of $705

last year to close at $390 on Friday.

With their Q2 results to be released on Tuesday, it may be a brave call

to jump in before, however for the contrarian investor is this the perfect

opportunity?

Why has the share price fallen?

The stock

has fallen 45% since its high in less than twelve months on fears that their

flagship products; the iPhone and iPad are losing market share demand of the

ever more competitive market.

A number of

companies who supply Apple parts have announced slowing sales which have

spooked investors. Cirrus Logic (CRUS)

which supplies analogue and audio chips for the iPhone and iPad announced good

earnings, however ended the year with over $20m in inventory reserves which

suggests slowing demand for Apple’s products.

The last

five years have seen Apple in its mass growth phase, and it is difficult to

quantify earnings potential and product demand until market saturation has been

met. The latest announcement from

Cirrus Logic highlights just this, whilst they had a great year, they may have

overestimated continued demand for Apple products.

The IDC recently

released data for their Quarterly PC Tracker and revealed preliminary estimates

had Apple ship 1.4m units, a 7.5% decline since 2012. They noted that this decline may have been

due to a steep rise in competition for the iPad. With more competitors producing cheaper

products, market share has been eroded.

Will Earnings Suffer?

Whilst

Apple has been relatively reserved about pipeline products their current ones

do a great job in hooking people for their next models. In 2011, UBS carried out some research into

retention rates for the iPhone; this was a whopping 89% with its nearest competitor

at 39%. Whilst we are a couple of years

down the line, previous earnings have supported the results. The 2013 Q1 results showed a record haul for

iPhone sales of 47.8m units compared to 37m a year before, iPads also followed

suit selling 22.9m compared to 15.4m the year earlier.

Although

Apple looks to have more competition against Samsung and Microsoft the

projected earnings for this year don’t look to suffer that much as a result.

First

quarter in 2013 saw record revenue at $54bn, however gross margin had decreased

somewhat from the year before.

The fall in

the share price has been attributable to very little hard facts and mostly on

speculation. Whilst many have been worried over the reducing gross margin, this

may have be down to cyclical factors used in product development. With the earnings looking to remain solid for

2013, contrarian investors will be licking their lips as the stock remains out

of favour falling below $400 a share.

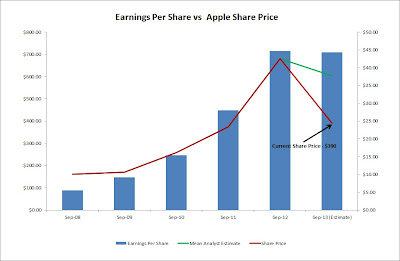

Earnings

per share looks to remain flat for 2013 which will not come as a surprise to

many because the gross margin looks to decrease somewhat from 2012. Capital equipment expenditure ahead of the

iPhone 5 release may have been the cause for this gross margin decrease and has

the potential to rise again once the iPhone 5S is released as modifications to

hardware are likely to be minimal.

Using Apple’s

lower end estimates they are looking to grow revenue and net profit for

2013. The current share price, just

based on earnings is very low and factoring in the vast amount of cash on their

balance sheet, $150bn, the company looks even more attractive. Looking at Google Inc (GOOG) a company with

similar merit, they have a P/E of 24.3 compared to Apple’s 8.7 (without $150bn

cash)!

What is next for Apple?

Pipeline

products are fundamental in this fast paced technology sector, and the company

has been relatively quiet about what is to come. They have hinted at a cheaper iPhone which

should help snatch up some of the market share against the cheaper competitors

and a new iPad release. It is likely

there are more products on the development line which are sure to draw in a

huge amount of revenue, however it is hard to pin point release dates.

China

Mobile is one of the world’s largest mobile networks without direct access to

the iPhone and this may be about to change as they look to invest $30bn in the

new 4G network that will support it.

Much time has been spent in generating a relationship with the company

and this summer may see Apple gain further exposure to the Chinese market.

One thing

is certain, the ever growing cash level that dwarfs Apple’s competitors

provides potential for some significant developments. There are a number of uses for this cash that

will be beneficial to the share price such as research and development,

M&A, share buy backs or increased dividends.

The share

price has fallen back to levels seen towards the end of 2011 and it is unlikely

earnings are going to do the same. The

market is pricing in a dramatic fall in earnings for 2013 and subsequent years

(almost 50%) and do not take into account new product releases.

Out of 55

broker recommendations, 80% rate this stock as a buy with a mean price estimate

of $602.

Apple is a

prime example of what contrarian investor’s look for; stocks that are out of favour with earnings and balance sheet strength. I agree with the brokers and at $390 Apple

shares are a steal.